As a Reminder I am covering these topics:

- A Land of Opportunity

- The Economy -1

- The Economy -2 (Current Topic)

- Energy

- National Security

- Education

- My Experience with an Election for "Change" in 1970

- The Change We Need

- Growth, Challenges, and Choices

While John McCain would not have been my first choice for President of the United States, my current choice is between John McCain

and Barack Obama, and after careful and detailed consideration, there is no question in my mind which is I must choose. Every day, the choice becomes clearer because of events of the day that confirm it. While both parties are suggesting change, change can be for the worse as well as for the better. Unfortunately,as much as I hope I am wrong I fear that we are on the brink of a Major Undesirable Change

Economic Nonsense

People keep saying that McCain needs to come out with more details about his economic plan. After all, Barack has laid out some details about his plan. The truth is that McCain does not have to promote the types of things that Barack proposes. Reactive and Bad Policy do not make things better. Barack's plan is about change. No more of the last 8 years. The Country needs change! The problem, even when things are bad they can change for the worse when bad policy is applied.

The Truth about the Last 8 Years, of the supposed failed Bush Policy, that no one wants to admit, because of the current sour economy, the image created by a less than friendly ore realistic press, and the desire to politically paint a picture that each candidate has to bring improvement.

- He inherited a waning economy from Bill Clinton

- He Lead the climb a huge hit on the Economy resulting from the 911 attacks on the US

- He submitted Tax Cuts that caused an Economy Resurgence and Record Tax Revenues (see Truth about Tax Rates...

below) - He Was ambushed by the Global Energy Crisis that was created partially, by a Congressional lack of desire to drill and produce oil domestically, lead by unrealistic environmental protectionism. The sky-high gasoline prices Americans paid all summer were effectively an energy tax, brought to us by policies limiting energy production supported chiefly by Democrats like Nancy Pelosi. Higher energy costs, had driven both the airline industry and the auto industry into turmoil, as well as added costs to nearly every product made in the US and globally. The end result recently being lost jobs domestically.

- He was hit with the Housing Market Crisis that resulted in an at least perceived need for government intervention, and was caused by liberal policy pushed by Democrats to make bad loans to assure everyone can afford a house, and who when oversight and controls were sought by George Bush, John McCain and others, made every attempt to avoid, including a party line vote to avoid tighter credit controls on the institution they protected, Fannie Mae and Freddie Mac. The result a financial crisis not of his making that has severely damaged the economy.

And now rather than acknowledging the Truth, Barack and the Democratic Congress point fingers at everyone else, and pretend that they are the answer.

The Truth about Tax Rates vs. Tax Revenues and Economy

An Major Error in Barack's Basic Message of Change, that he Assumes the Younger and Less Informed Will Not Recognize

Barack Obama says in his add- "Well now we know the truth. It didn't work. Instead of prosperity trickling down, pain has trickled

up." This is a direct reference to Reagan's "Trickle Down" economic's policy which if you look at the real history rescued the US from the

most recent deep recession and produced an economy that boomed with a few fluctuations through the Bush

1 and Clinton Administrations and which was re-vitalized during the Bush 2 administration after 911 until the

Energy and Housing Crisis brought the economy down.

Simultaneously with the enactment of the tax cuts in 1981 the Federal Reserve Board, with the full support of the Reagan Administration, altered monetary policy so as to bring inflation under control. The Federal Reserve's actions brought inflation down faster. As inflation came down and as more and more of the tax cuts from the 1981 Act went into effect, the economic began a strong and sustained pattern of

growth. Though the painful medicine of disinflation slowed and initially hid the process, the beneficial effects of marginal rate cuts and reductions in the disincentives to invest took hold as promised. -US Treasury - History of the US Tax System

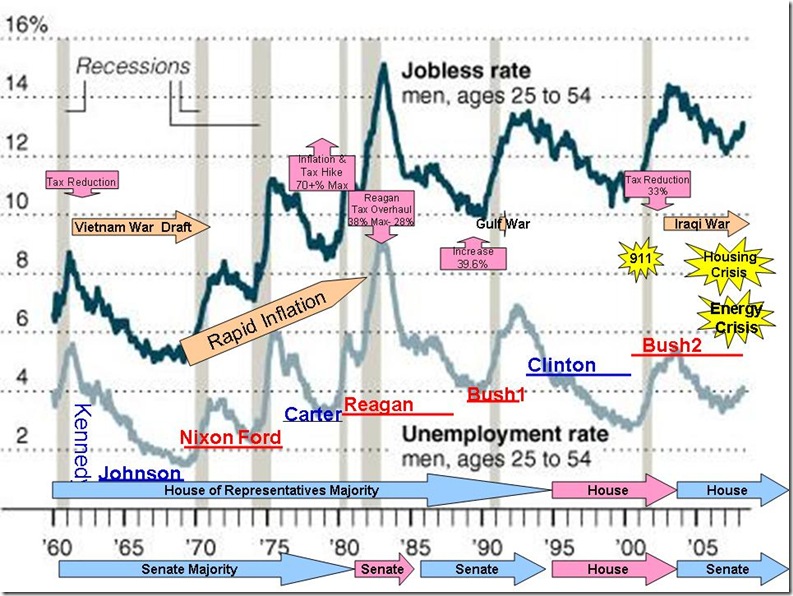

Looking at the above view of the jobless aspect of the economy over the last 48 years,it is clear from history, that while there is a constant cycle of good to bad economy, Tax Reduction on the High Income and Corporate Level us what created jobs by stimulating the economy. The tax increases both inflationary as well as imposed by Carter introduced us into our last great recession. Tax overhaul and reduction by Ronald Reagan's "Trickle Down" economics fueled lasting growth. It worked again to restore the economy under George Bush 2 after 911 and prior to the recent Energy and Housing

Crisis

The Tax Burden Already Bore by the Wealthy

The Congressional Budget Office joined the IRS in releasing tax numbers for 2005, and part of the news is that the richest 1% paid about 39% of all income taxes that year. The richest 5% paid a tad less than 60%, and the richest 10% paid 70%. These tax shares are all up substantially since 1990, and even somewhat since 2000. Meanwhile, Americans with an income below the median -- half of all households - - paid a mere 3% of all income taxes in 2005. The richest 1.3 million tax-filers -- those Americans with adjusted gross incomes of more than $365,000 in 2005 -- paid more income tax than all of the 66 million American tax filers below the median in income. Ten times more. - Wall street Journal Taxes and Income

Up until the recent Crisis there has been a great upward mobility among Americans

America continues to be a society of upward income mobility. Over the past decade, millions of

Americans have joined the once highly exclusive club of six- and seven-figure earners. Some 304,000

Americans earned $1 million or more in annual income in 2005, compared to 110,000 in 1996 and

176,000 in 2000. Because there is no cap on the top income share, this increase in millionaires pushes

the top income (and taxes paid) share higher. The number of millionaire households in net worth also

increased to nine million in 2006, up from six million in 2001, according to TNS, a global market

research firm. - Wall street Journal Taxes and Income

History of Taxes and Bad Economic Times

In October of 1929 the stock market crash marked the beginning of the Great Depression. As the economy shrank, government receipts also fell. In 1932, the Federal government collected only $1.9 billion, compared to $6.6 billion in 1920. In the face of rising budget deficits which reached $2.7 billion in 1931, Congress followed the prevailing economic wisdom at the time and passed the Tax Act of 1932 which dramatically increased tax rates once again. This was followed by another tax increase in 1936 that further improved the government's finances while further weakening the economy. By 1936 the lowest tax rate had reached 4 percent and the top rate was up to 79 percent. In 1939, Congress systematically codified the tax laws so that all subsequent tax legislation until 1954 amended this basic code. The combination of a shrunken economy and the repeated tax increases raised the Federal government's tax burden to 6.8 percent of GDP by 1940. - US Treasury - History of the US Tax System Beginning in the late 1960s and continuing through the 1970s the United States experienced persistent and rising inflation rates, ultimately reaching 13.3 percent in 1979. During this time, the income tax was not indexed for inflation and so, driven by a rising inflation, and despite repeated legislated tax cuts, the tax burden rose from 19.4 percent of GDP to 20.8 percent of GDP. Combined with high marginal tax rates, rising inflation, and a heavy regulatory burden, this high tax burden caused the economy to under-perform badly - US Treasury - History of the US Tax System

The Hidden Truth about Obama's Promise to Lower Taxes

Obama Says he will lower taxes on small businesses, but what he is not telling you is that at least 90% of small business are LLCs, Partnerships, and Sub-Chapter S Corporations, and as such are not subject to Corporate Income Tax, but the revenue passes directly to the owners who are Individual Tax Payers, with at least 50% being in the $250k plus category and thus will be subject to taxes of more than 50% and approaching 70%. If a business has to pay $.55 - $.70 in taxes on every dollar of income, business will look for other ways to invest their money resulting at the best in no new jobs and more likely a reduction in jobs.

The other truth is that the American Dream stops when you make $250,000. There is no reason to work any harder, to create bigger businesses, or create more jobs. It is the American Dream that anyone who desired to work hard and had good ideas could succeed, that made our country stand out. Under this type of environment, our economy and opportunity will not be globally competitive. Jobs will go overseas, where there are less taxes and lower salaries, and our unemployment will sky rocket.

News Flash - Obama Offers a $3,000 tax Credit to Small Business for Every New Job Created - A Pure Political Ploy

Today, October 13, Barack Obama to show how he will re-build the struggling economy, stated that he will provide small business a $3,000 tax credit for every new job they create, as long as those jobs are still in existence in 1 year. To the unthinking ear on the street and pushed by the press, this sounds like a very magnanimous offer. The real truth? Businesses create jobs to make money. They do not hire new employees if they do not see a profit in doing so, in which case they will create the job anyway. For a business to get a $3,000 tax credit after one year, the employer would have to pay the job's wage, let's say it is only $30,000. They have to pay the employer Social Security and Medicare taxes, $3,600. They have to pay unemployment insurance. They may have to pay Medical Insurance (a reduced rate under Obama). The $3,000 tax credit has now cost the company around $40,000 to earn. If the company can't make a profit, the job still will not be created, and Obama knows it. When it does not work, he will blame big business for not using the tax credit incentive to create more jobs.

Obama's Inadvertent Admission that Taxation is Bad Policy

A month ago Obama said he would postpone raising taxes if economy is in trouble - He has recently pulled back from that position, since he know that it clearly communicated that he knows raising taxes has a negative impact on the Economy. And If it has a negative impact on the Economy now and would drive us deeper into recession/depression, then why would increasing taxes anytime do anything but hurt the economy? He steers clear of this statement now, saying he will have to evaluate the situation when he get's in office.

Obama and the Democrat Party's Coming Gift to America

They have already gave us a financial crisis, which they love, because it invited the Government to Step into the position of saving the citizen, and taking more power in the form of owning the Credit Industry. (Nationalization). In essence they have achieved control over the lending industry, and having control, they will be slow to release it. They now want control of the medical and insurance industry guised in a fair Healthcare Plan. They again say all of the things that sound good. You will not have to pay more. You will have the same coverage as ... How will the do it? They will pressure (force) the Insurance Industry to lower their rates. Insurance companies, like every other business, is in existence to make a profit to return to investors. If the Government is going to force the insurance companies to accept lower rates, they will make less money and either go out of business or be bailed out by the benevolent government who will not let them fail, and thus take control of another segment of the free market. And then we will have Banking, Housing, Insurance, Medical all run by the same inefficient structure that wasted away their first great promise "Social Security".

I CAN NOT SUPPORT THIS TYPE OF CHANGE!

2 comments:

American politics, as many farmers and farm-state politicians have tied their political and economic hopes to this option. The biggest difference in the US economy and ours is reflected in the mortgage market and housing market. Obama wants to offer it to more of the uninsured, and it will take taxes to pay for it. McCain proposes a tax credit, enabling individuals to purchase their own insurance.

-------------------

Sally

Social Advertising

One of the biggest problems I see in my friends of my generation is that our education stinks! We have taken history classes, but usually by a biased political party. Not to mention the fact that a lot of teachers grade too easily and don't really TEACH! My friends don't know hardly anything about our country nor, world history that warns us of the dangers our nation will face if Obama is elected! I have learned so much from taking my Humanities classes about history. We don't just study art, but religion and the history of nations governments and why they fell! We never learned some of this stuff in high school, and that's a shame.

Post a Comment